tulsa oklahoma auto sales tax

The Tulsa County Oklahoma sales tax is 487 consisting of 450 Oklahoma state sales tax and 037 Tulsa County local sales taxesThe local sales tax consists of a 037 county. This includes the rates on the state county city and special levels.

West Point Auto Sales Tulsa Ok

State of Oklahoma 45.

. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. State of Oklahoma 45. A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax.

An average value for all such model vehicles is utilized. The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price.

This includes the rates on the state county city and special. In the state of Oklahoma sales tax is legally required to be collected from all tangible physical products being sold to a consumer. The Oklahoma sales tax rate is currently.

What is the sales tax rate in Tulsa OK. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. Typically the tax is determined by the purchase.

Tulsa County 0367. How much is tax by the dollar in Tulsa Oklahoma. Lawmakers passed House Bill 2433.

Standard vehicle excise tax is assessed as follows. This auction is for the sale of real estate for non-payment of ad valorem property taxes or non-payment of special assessments such as cleaning and mowing. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way.

This is the largest of Oklahomas selective sales taxes in terms of revenue generated. Together these two motor vehicle taxes produced 728 million in 2016 5 percent of all tax revenue in. Tulsa County 0367.

Tulsa OK Sales Tax Rate. Some cities and local governments in Tulsa County collect. The average cumulative sales tax rate in Tulsa County Oklahoma is 88 with a range that spans from 487 to 1063.

2483 lower than the maximum sales tax in OK. The December 2020 total local sales tax rate was also 8517. The average cumulative sales tax rate in Tulsa Oklahoma is 871 with a range that spans from 852 to 98.

Tulsa County will auction. City 365. Inside the City limits of.

Oklahoma has a 45 statewide sales tax rate but also has 471 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 426. Oklahomas motor vehicle taxes are a combination of an excise sales tax on the purchase of a vehicle and an annual registration fee in lieu of ad valorem property taxes. This is the total of state county and city sales tax rates.

While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does. 325 of the purchase price or taxable value if different Used. An example of an item that exempt from Oklahoma is.

OKLAHOMA CITY Car dealers are asking the Oklahoma Supreme Court to prevent a law putting a sales tax on vehicles from taking effect. The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax. The minimum combined 2022 sales tax rate for Tulsa Oklahoma is.

Vehicle Sales Tax in. See reviews photos directions phone numbers and more for the best Taxes-Consultants Representatives in Tulsa OK. The current total local sales tax rate in Tulsa OK is 8517.

New Cars Trucks Suvs In Stock Jenks Nelson Mazda Tulsa

Used Honda Pilot For Sale In Tulsa Ok Edmunds

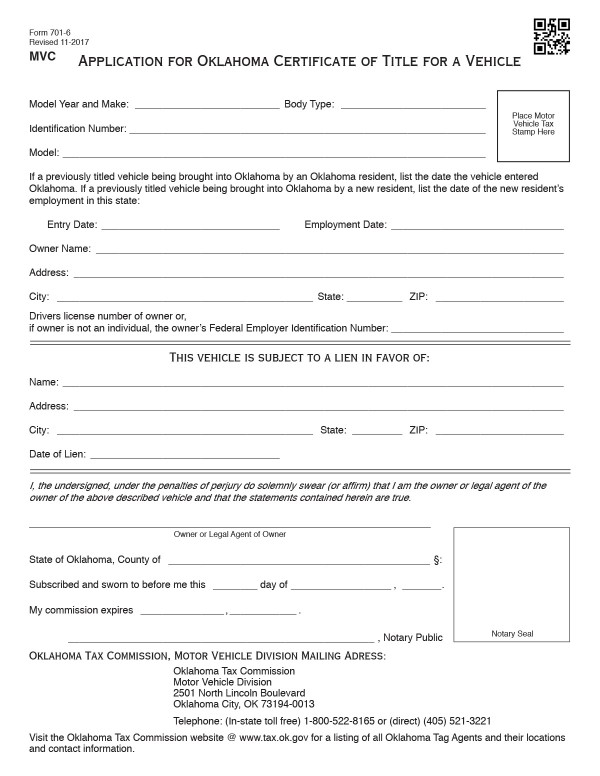

Bills Of Sale In Oklahoma The Templates Facts You Need

Used Chevrolet Ssr For Sale In Tulsa Ok Edmunds

Ford Dealership Tulsa Ok Broken Arrow Bixby Cars For Sale

Vtg Swinson Chevrolet Car Dealership Emblem Tulsa Oklahoma Logo Tag Advertising Ebay

Buy A Used Car In Tulsa Ok Oklahoma Used Vehicle Sales

Used Electric In Tulsa Ok For Sale

Tulsa Oklahoma 1950s Postcard The Mayo Hotel Cars Bus Ebay

Lawmakers Seek Repeal Of Sales Tax On Vehicles

Bmw Of Tulsa Bmw Dealer Tulsa Ok

Used Cars For Sale In Tulsa Bill Knight Ford

Plan To Raise Oklahoma S Sales Tax Has Supporters Detractors

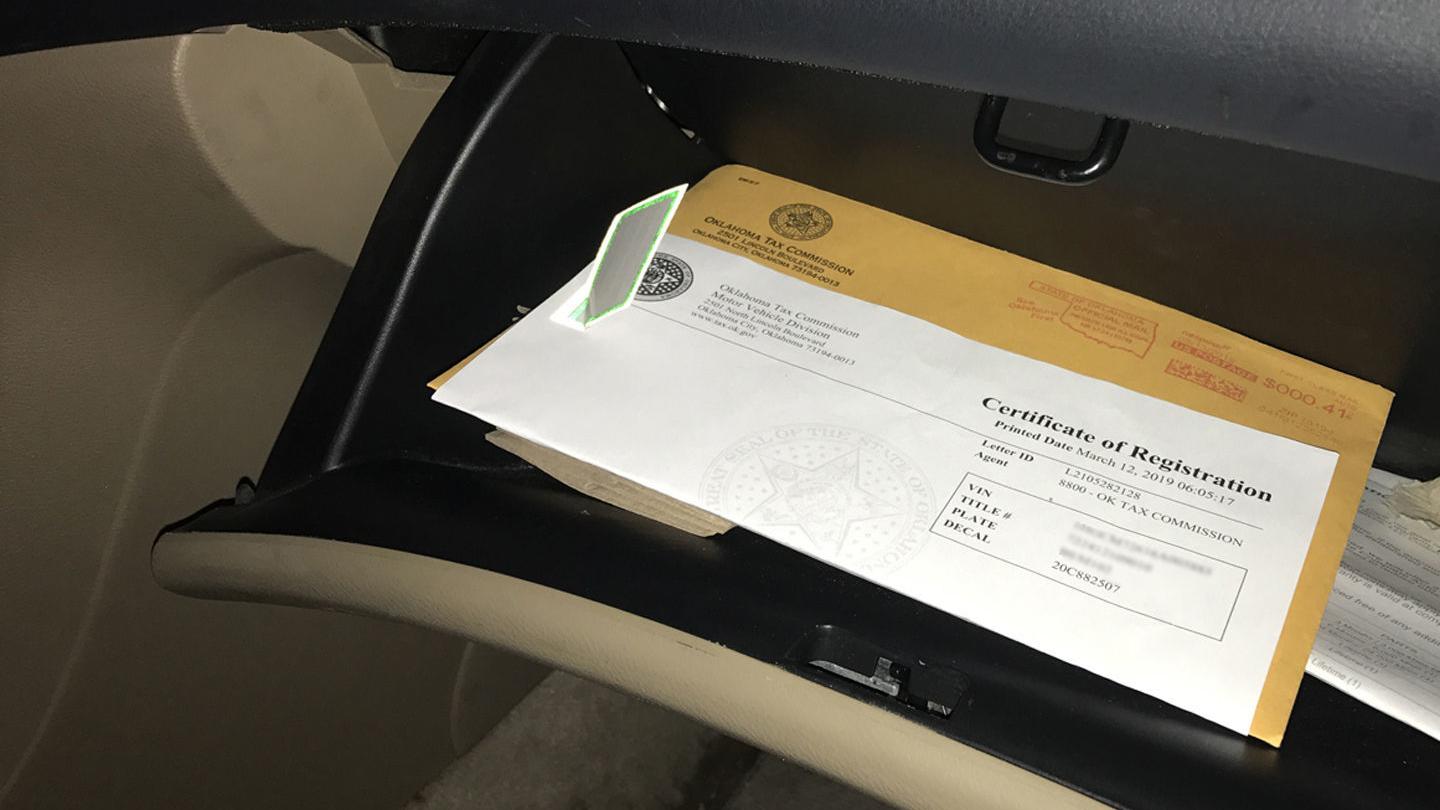

Update State Will Email Free Registration Certificates After Law Change That Also Keeps Plates With The Driver

Carmax Tulsa Used Cars In Tulsa Oklahoma 74133

Ford Dealership Tulsa Ok Broken Arrow Bixby Cars For Sale

City Of Tulsa Selects Developer To Lead New Route 66 Mixed Use Project

1960s Ok Postcard Downtown Shopping District Main Street Tulsa Oklahoma Taxi Ebay